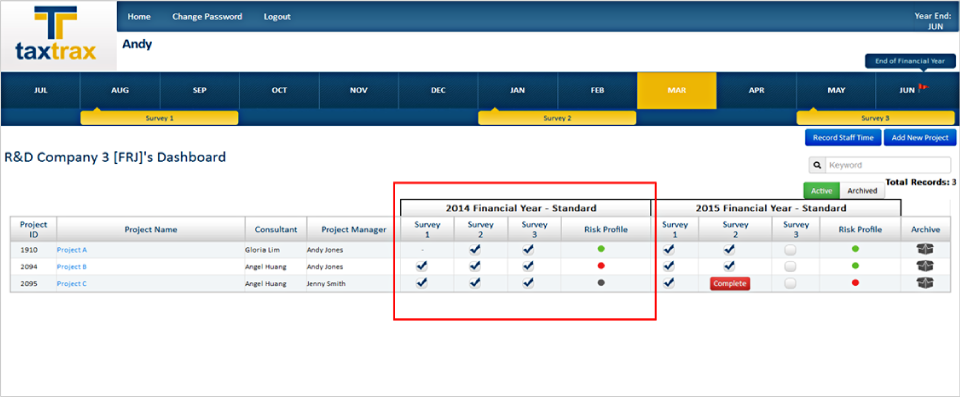

Intelligent Survey System

TaxTrex surveys were designed by experts to capture the scientific process as it happens. Once a project is

created, surveys are issued at three regular intervals throughout the year. <learn more>

Building the claim profile

TaxTrex uses survey information to build an R&D claim profile. TaxTrex will only report on the useful information. <watch video>

Short and effective surveys

By completing three 20-minute surveys per year, your company can spend less time on paperwork. <watch video>

Real-time Risk Assessment

The risk assessment algorithm will alert you on issues with eligibility, lack of substantiating documents, feedstock concerns and other areas that may put the R&D claim at risk. <learn more>

Identify and Resolve

TaxTrex’s real-time risk assessment algorithm goes over the information collected from the surveys and creates a risk profile for the R&D claim. The algorithm evaluates the status of the claim and alerts you if an action is necessary.

If any issues arise, Swanson Reed’s R&D experts will be available to help you ensure your R&D claim is quickly back to good standing. <watch video>

Phone Support: 1800 792 676

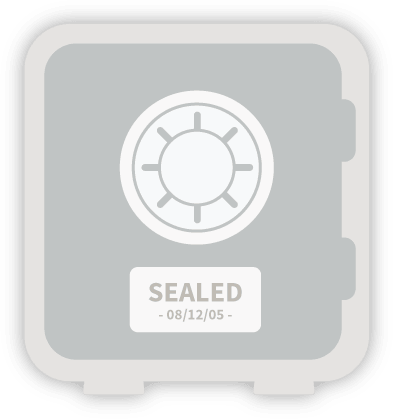

Nothing beats time-stamped documents.

TaxTrex’s three annual surveys are digitally signed and sealed with the time and date of completion.

These time-stamped documents prove the iterations of the projects over time, which will help you defend your claim in the event of an audit. <learn more>

Document Storage System

TaxTrex provides a centralised document storage facility, allowing you to upload and store relevant files.

Documents such as design iterations, technical feedback, and test results help to build a story about the progress of your project. TaxTrex’s unique document storage facility allows you to upload and store all your research accommodating documents. <learn more>

Commercially Track Staff Time

TaxTrex time tracking system allows you to easily and accurately track the amount of time your staff spend working on R&D projects. By recording this information at regular intervals throughout the year, R&D staff costs are captured, recorded and time-stamped.

This unique feature helps you to accurately substantiate your costs and maximise your R&D claim’s benefit . <learn more>

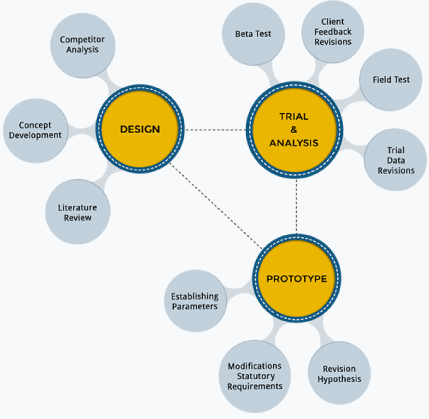

Visual Summaries & Activity Mapping

An R&D project has many contributing parts, causing confusion to the taxpayer, their R&D adviser and their accountant. At any point throughout the year, TaxTrex can produce a visual summary of research activities in progress to give you a bird’s eye view of exactly what is going on. <watch video>

Research based:

Tested on 500+ R&D claims per year over a 4 year period

This core feature of TaxTrex is what separates it as the professional’s choice.

Swanson Reed’s in-depth research into R&D claims and case law was published in Taxation in Australia. The research conducted in this paper formed the basis for the TaxTrex concept. <learn more>